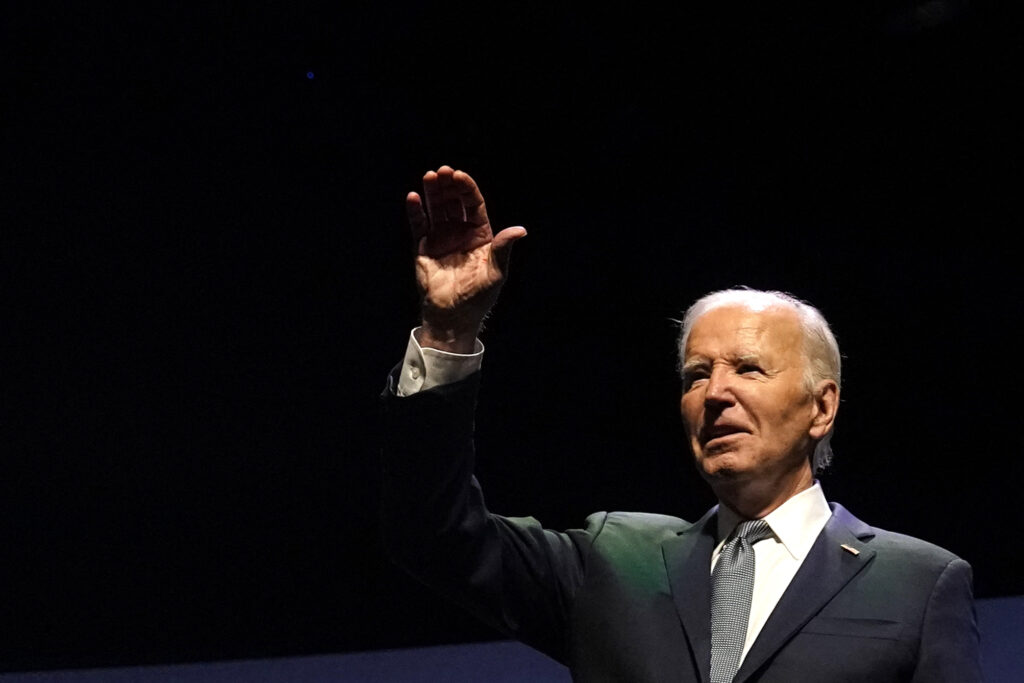

How Biden’s Decision to End Re-Election Campaign Could Shape Currency Markets and Economic Policies

Market Update

The U.S. dollar experienced a slight uptick on Monday in a relatively calm trading session as investors processed President Joe Biden’s decision to end his re-election campaign. This development could potentially inject more volatility into the currency market. However, the dollar weakened against the yen after two consecutive days of gains.

Upcoming Monetary Policy Meetings

Market participants are also keenly anticipating next week’s critical Federal Reserve and Bank of Japan (BOJ) monetary policy meetings. The Federal Reserve might signal the commencement of its easing cycle by the next meeting in September. In contrast, the BOJ is expected to start raising interest rates, which could boost the yen.

Political Focus: U.S. Presidential Race

Investors remain focused on the U.S. presidential race, especially after Biden’s announcement. The dollar and Treasury yields dipped slightly earlier on Monday but reversed the losses later in the day. Former President Donald Trump, the Republican nominee, is leading in betting markets.

According to Jonas Goltermann, Deputy Chief Markets Economist at Capital Economics, “Overall, these moves still suggest investors are, for the most part, looking to Trump’s first term as the best available guide for what to expect from a potential second one. In other words, higher Treasury yields, a stronger dollar, and a generally constructive environment for equities.”

Kamala Harris Endorsed as Democratic Candidate

President Biden has endorsed Vice President Kamala Harris to succeed him as the Democratic candidate in the November 5 election. Harris has received backing from many within the party, including former House Speaker Nancy Pelosi. However, some high-profile figures, such as former President Barack Obama, have remained silent.

Dollar Index and Currency Pairs

The dollar index, which measures the greenback’s value against a basket of foreign currencies, rose by 0.1% to 104.32. Amo Sahota, Executive Director of Klarity FX, noted that the dollar/Mexican peso pair reacted significantly to Biden’s exit. The dollar fell by 0.6% to 17.925 pesos.

Analysts also observed that the yen might be at a turning point against the dollar due to the contrasting monetary policy expectations of the Fed and BOJ. The greenback fell by 0.3% versus the yen to 157.10, while the euro remained flat against the dollar at $1.0886.

Central Bank Policies

The Federal Open Market Committee (FOMC) and BOJ will hold two-day policy meetings on July 30-31. Money markets have nearly fully priced in a Fed rate cut by September. The People’s Bank of China unexpectedly cut the seven-day reverse repo rate to 1.7%, followed by reductions to the one- and five-year loan prime rates. This led to a 0.1% rise in the dollar to 7.29 yuan in offshore trading.

Australian Dollar and Cryptocurrencies

The Australian dollar, often seen as a proxy for China risks, fell by 0.7% to U.S.$0.6640. In the cryptocurrency market, investors are preparing for the launch of exchange-traded funds (ETFs) tracking ether. Despite the anticipation, market players do not expect the massive inflows seen with bitcoin ETFs. Ether was last down 0.3% at $3,496, while bitcoin rose by 1.8% to $68,182.

Forex and Cryptocurrency Data

| Currency Pair | Bid | Last Close | Pct Change | High | Low |

|---|---|---|---|---|---|

| Dollar Index | 104.32 | 104.22 | +0.1% | 104.42 | 104.18 |

| Euro/Dollar | 1.0886 | 1.0883 | +0.04% | $1.0903 | $1.0873 |

| Dollar/Yen | 157.08 | 157.48 | -0.24% | 157.615 | 156.73 |

| Euro/Yen | 171.38 | 171.65 | -0.21% | 171.65 | 170.08 |

| Dollar/Swiss | 0.8895 | 0.889 | +0.06% | 0.8902 | 0.8871 |

| Sterling/Dollar | 1.2929 | 1.2911 | +0.15% | $1.2942 | $1.2873 |

| Dollar/Canadian | 1.3752 | 1.3728 | +0.19% | 1.3775 | 1.3706 |

| Aussie/Dollar | 0.6641 | 0.6685 | -0.65% | $0.6702 | $0.6632 |

Never miss any important news. Subscribe to our newsletter.

Related News

USD/INR Slows Down Amid Mixed Indian PMI Data.

USD/INR Rises as Markets Anticipate Fed Rate Decision.

Gold Price Nears Record High Amid Strong Safe-Haven Demand.

USD/INR Gains Momentum Amid Trade Tariff Uncertainty.

Never miss any important news. Subscribe to our newsletter.

Editor's Pick

USD/INR Slows Down Amid Mixed Indian PMI Data.

USD/INR Rises as Markets Anticipate Fed Rate Decision.