Understanding Leverage in Forex Trading

Leverage in forex trading is a powerful tool that allows you to control larger positions with a smaller amount of your own capital. By using leverage, traders can amplify both potential profits and potential losses. For instance, with a leverage ratio of 100:1, you can control a $100,000 position with just $1,000 of your capital. This feature makes forex trading attractive to both beginner and experienced traders.

How Leverage Works in Forex

When trading with leverage, you essentially borrow money from your broker to open positions that are larger than what your account balance would normally allow. The margin is the amount of money you need to maintain to keep your position open, and it varies based on the leverage ratio.

For example, if you’re using 100:1 leverage, the required margin is just 1% of the trade size. If the market moves in your favor, leverage can boost your profits, but if the market moves against you, it can result in significant losses.

Risks of Leverage in Forex

While leverage can maximize your profit potential, it also comes with increased risks. A slight market movement in the opposite direction can lead to magnified losses, which could exceed your initial capital if not managed carefully.

Key Risk Management Strategies

To mitigate the risks of using leverage in forex trading, it’s essential to implement proper risk management techniques:

- Stop-loss orders: Set predetermined exit points to limit losses.

- Position sizing: Ensure that your position size is appropriate for your account balance.

- Leverage ratio: Use a leverage ratio that aligns with your risk tolerance and trading strategy.

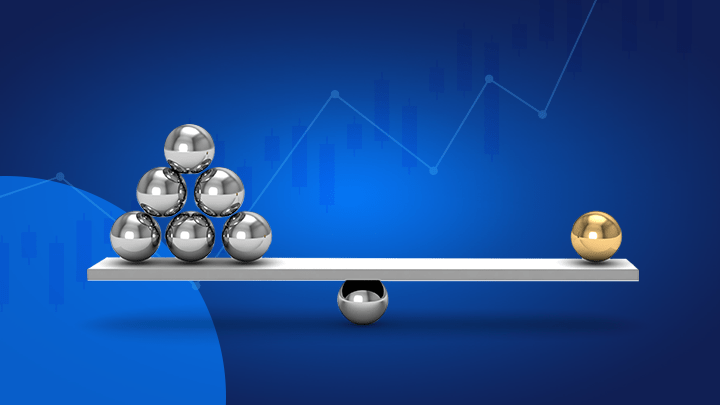

Conclusion: The Balance Between Opportunity and Risk

Leverage can significantly enhance your forex trading opportunities, but it’s critical to manage it responsibly. Always keep in mind that while it increases your potential for gains, it equally increases your risk of losses. Proper risk management and understanding of market conditions are vital when using leverage.

By mastering leverage, you can take full advantage of the forex market’s potential, but make sure to start with smaller positions and increase them as your experience grows.

Never miss any important news. Subscribe to our newsletter.

Related News

USD/INR Slows Down Amid Mixed Indian PMI Data.

USD/INR Rises as Markets Anticipate Fed Rate Decision.

Gold Price Nears Record High Amid Strong Safe-Haven Demand.

USD/INR Gains Momentum Amid Trade Tariff Uncertainty.

Never miss any important news. Subscribe to our newsletter.

Editor's Pick

USD/INR Slows Down Amid Mixed Indian PMI Data.

USD/INR Rises as Markets Anticipate Fed Rate Decision.